Paper by Downing Fellow chosen as the cover story for financial journal

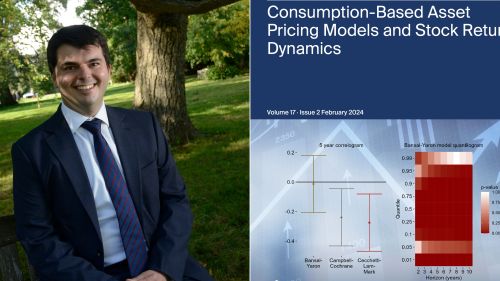

A paper co-written by Downing Fellow in Economics, Dr Michael Ashby, has been selected as the cover story for the Journal of Risk and Financial Management.

‘Do Consumption-based Asset Pricing Models Explain the Dynamics of Stock Market Returns’ was co-written with Economics Faculty Chair Oliver Linton and is the cover story for the journal's special issue in ‘Advanced Studies in Empirical Asset Pricing’.

The paper argues that the three prominent consumption-based asset pricing models - the Bansal–Yaron, Campbell–Cochrane and Cecchetti–Lam–Mark models - cannot explain the dynamic properties of stock market returns. This is argued by estimating these models and comparing the model-implied returns to observed stock returns. Further tests reveal that the key variables that explain stock returns in the models are not sufficient to explain observed returns.

Dr Ashby said: “Our results show that, while important theoretical developments, the models we have studied are not able to explain what we observe in practice. These sorts of models require certain technical assumptions and future work should look at relaxing those, as well as examining entirely new classes of models.”

Published 19 March 2024